Welcome To The City of Campbellsville!

The Heart of Kentucky  Building A Better City Together!

Building A Better City Together!

Announcements:

January 27, 2026:

January 26, 2026:

January 25, 2026:

Announcements:

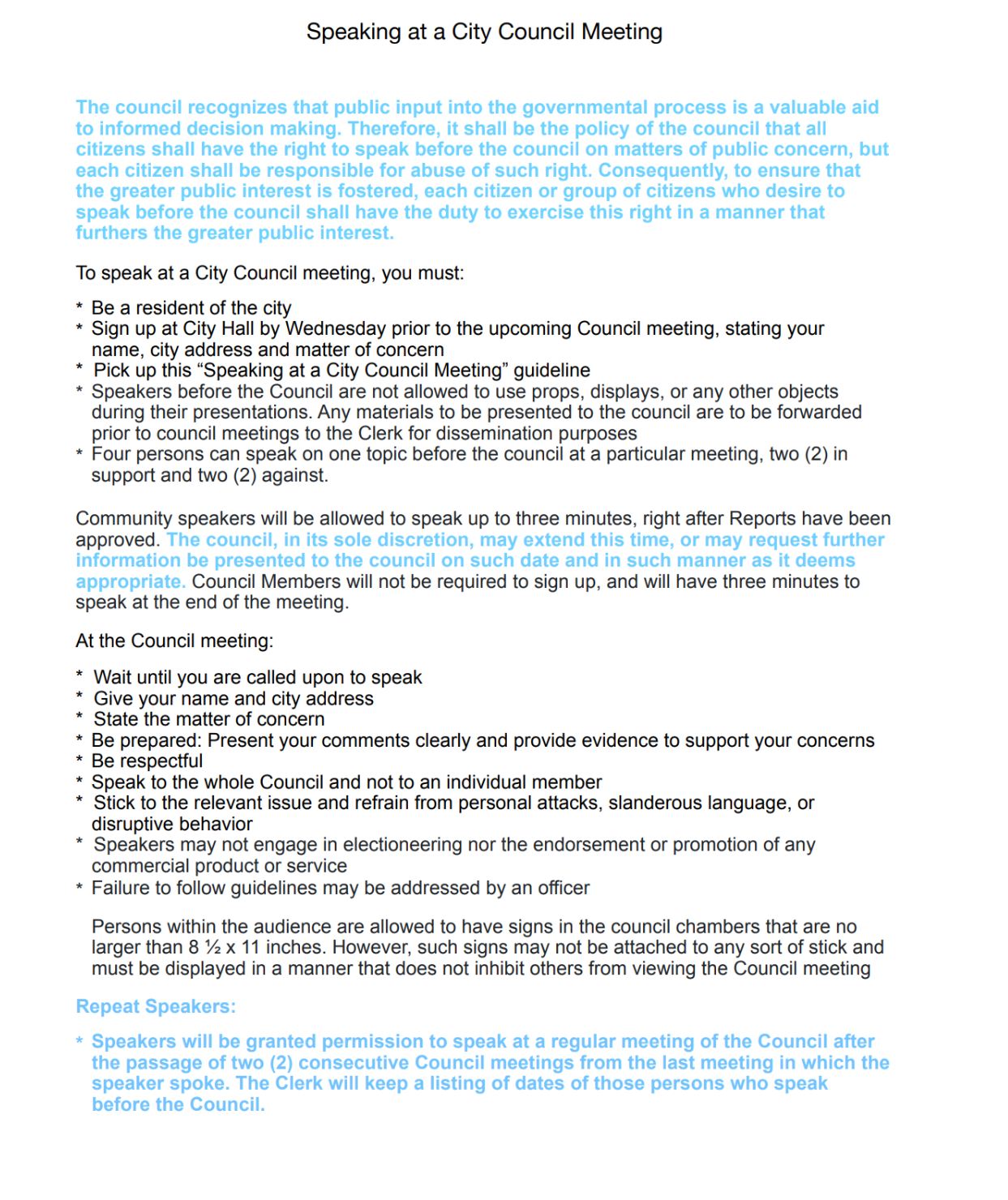

Guidelines for speaking at City Council Meetings:

Announcements:

Announcements:

Announcements:

Announcements:

Announcements:

REQUEST FOR PROPOSALS

The City of Campbellsville is requesting proposals from any and all non-profit entities or governmental entities relating to the use of Opioid Settlement Funds which have been awarded to the City of Campbellsville. The applicant must use the funds consistent with certain statutory criteria which is the subject of a Memorandum of Understanding which can be obtained from the City Clerk. The proposal should include the applicant’s plan for utilizing the funds, the history of the applicant in the area of the proposal, how the applicant will comply with the statutory criteria, how the applicant will comply with applicable statutes and an explanation as to the sustainability of the program. Applications shall be submitted on or before August 15, 2025 and shall be submitted to the City Clerk, 110 South Columbia Avenue, Suite B, Campbellsville, Kentucky 42718.

Announcements:

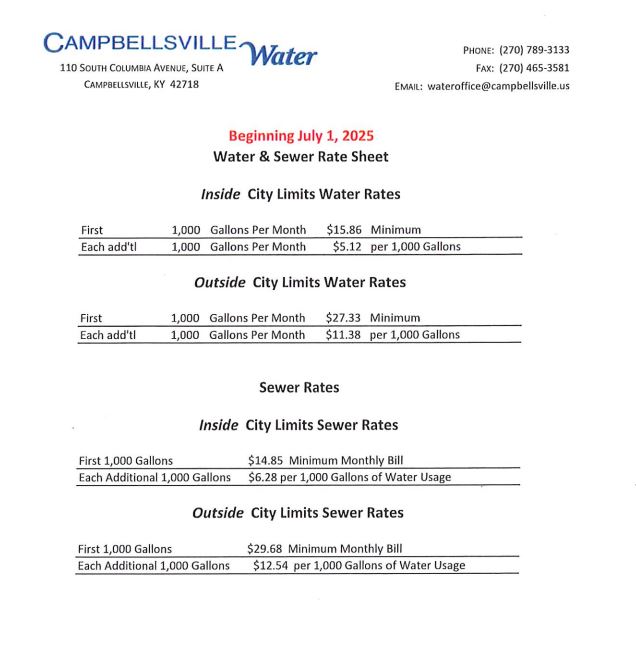

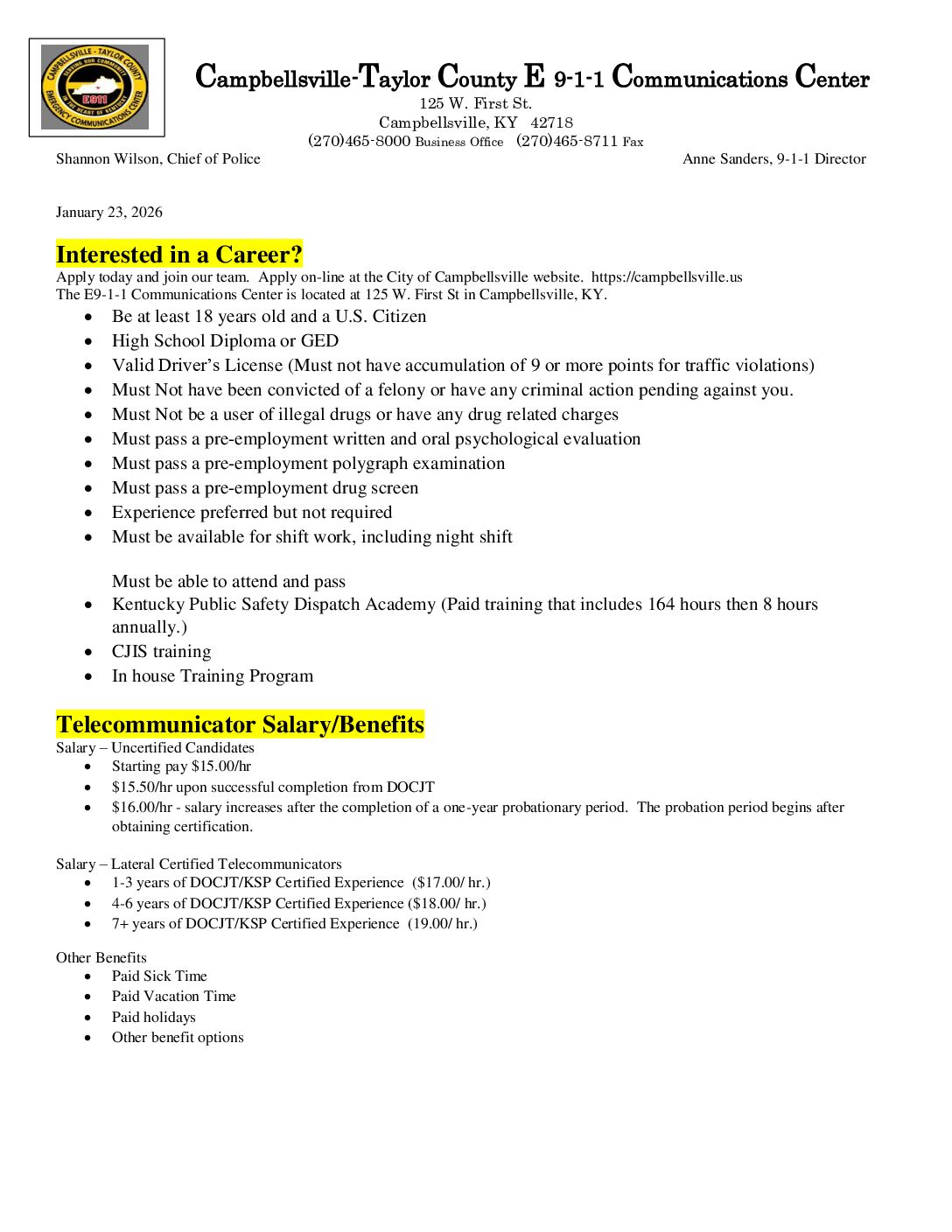

Campbellsville-Taylor County E 9-1-1 Communications

125 W. First St. Campbellsville, KY 42718

270 465-8000 270 789-8711 (fax)

How to Apply

Submit completed job application.

Applications can be submitted on line by visiting: Here

or picked up in person at City Hall located at 110 S. Columbia Ave, Campbellsville, KY.

To submit an online application, click: Online Application

To print an application to manually fill out, click: Printable Application

Building A Better City Together!

Building A Better City Together!